Opening a US bank account from abroad in 2025 is entirely feasible for non-residents, including those targeting US, UK, and Canadian audiences seeking global financial access. Whether you’re a digital nomad, freelancer, international business owner, or planning a move to the US, this comprehensive guide covers every step, required documents, top bank recommendations, and fintech alternatives. Drawing from expert sources like Wise’s foreigner banking guide and Nomad Gate’s non-resident strategies, you’ll learn proven methods to bypass common hurdles like lacking an SSN or US address

Why Open a US Bank Account as a Non-Resident?

A US bank account unlocks seamless dollar transactions, lower international fees, and credibility for global payments. US dollars dominate freelance platforms, e-commerce, and investments, making it essential for UK and Canadian professionals working with American clients. Non-residents gain privacy advantages since the US doesn’t share account data with foreign tax authorities, unlike many reciprocal agreements. However, traditional banks prioritize in-person verification for anti-money laundering (AML) compliance, so preparation is key—unlike simpler processes outlined in Wise’s overview for immigrants.

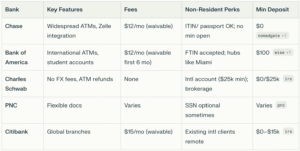

Challenges include SSN requirements and address proof, but 2025 options like ITIN acceptance and remote fintechs have expanded access. Nomad Gate emphasizes bigger banks like Chase and Bank of America for their foreigner-friendly policies in hubs like New York or Miami. For US/UK/Canada audiences, this means easier payroll from platforms like Upwork or Stripe.

Essential Documents and Requirements

Gather these upfront to avoid delays:

-

Primary ID: Valid passport (required by all banks).

-

Secondary ID: Driver’s license, national ID, or Matricula Consular.

-

Tax ID: SSN preferred, but ITIN (via IRS Form W-7) or EIN for businesses works at major banks like Chase. Bank of America accepts Foreign Tax ID Numbers (FTIN).

-

US Address Proof: Utility bill, lease, or bank statement. Virtual mailboxes or relative addresses often suffice, though P.O. boxes may not—Reddit users confirm physical addresses boost approval.

-

Initial Deposit: $25–$100 typically; higher ($25,000+) for premium international accounts at Charles Schwab.

-

Business Extras: LLC formation docs, EIN letter, operating agreement for company accounts.

No SSN? Apply for ITIN abroad by mailing Form W-7 with passport copies to the IRS—processing takes 7–11 weeks. PNC notes exemptions for some non-residents.

Step-by-Step Process to Open Your Account

Follow this roadmap for success in 2025:

-

Research and Contact Banks: Call branches in international hubs. Confirm non-resident policies—Chase accepts ITIN/passport combos remotely in some cases.

-

Obtain Tax ID if Needed: File IRS Form W-7 with proof of foreign status and tax need (e.g., US income). Certified Acceptance Agents speed this up.

-

Secure US Address: Use services like Anytime Mailbox or a trusted contact. Nomad Gate warns against overused virtual addresses.

-

Apply Online or In-Person: Start digitally where possible (e.g., Alliant Credit Union for ITIN holders). Visit for verification—major banks process in 10–30 minutes.

-

Fund the Account: Wire transfer, cash, or check. Verify via app setup.

-

Activate and Monitor: Order debit card (mailed to US address), enable Zelle for P2P, and link to mobile banking.

For remote-only, fintechs shine—more below. Wise details this for foreigners planning US moves.

Business-focused? Mercury and Relay for LLCs—no SSN needed, FDIC up to $5M. Entity.inc ranks these top for 2025 non-resident founders.

Best Fintech Alternatives for Remote Opening

Skip branches with these—no US address/ITIN required:

-

Wise: Multi-currency (40+ incl. USD), ACH details, debit card. Low FX (0.41%). Ideal for UK/Canada freelancers.

-

Mercury: LLC business banking, free wires, high yields. Remote for non-residents.

-

Relay: Similar to Mercury, API integrations for tech users.

Nomad Gate calls Charles Schwab #1 for nomads, but Wise for quick setup.

ITIN Application Guide for Foreigners

-

Complete Form W-7 accurately.

-

Attach passport/original docs or certified copies.

-

Mail to IRS or use agent. Exemptions for investments/freelance income qualify you.

Processing: 7 weeks. Reddit success stories highlight Chase ITIN approvals with US bills.

Common Pitfalls and Pro Tips

-

Avoid Scams: Skip “no-doc” services; stick to verified banks.

-

Fees Watch: 3% FX common—use Schwab/Wise to dodge.

-

Travel Tip: Visit NYC/Miami branches experienced with internationals.

-

Taxes: US interest tax-free for non-residents sans US business.

-

Credit Building: Post-account, get secured cards via ITIN.

Mastering a US bank account from abroad empowers your finances across US/UK/Canada markets. Start with docs, pick Chase or Wise, and verify locally. This guide, informed by Wise and Nomad Gate, equips you fully—act now for 2025 opportunities